Why Jusan Bank chose Jmix for digital transformation

Ease of learning for those new to Jmix

Cost efficiency

Rapid development of 13 web-applications

The Story of Jusan Bank

Jusan Bank is a well-known Kazakh retail bank established in 1992, with more than 19 regional branches and 116 offices. The bank offers a wide range of services that include retail and corporate banking, deposits, overdrafts, savings accounts, online banking, cash management, and various types of guarantees.

Problem

In 2019, the bank faced the need to digitize its business processes, which required approval, a significant amount of time, and electronic document management. To address this challenge, Jusan Bank team have chosen the Jmix platform (formerly CUBA).

Why Jmix

When choosing a platform for developing a CRM system for Jusan Bank, the key factors were:

- Market attractiveness;

- Cost of the license;

- Development speed;

- Functional and non-functional requirements;

- Compliance with the bank's standards and legislation.

Development Speed

Jmix platform can enable rapid development. Jusan Bank's developers experienced this firsthand on a project with the contact center. During its implementation, the bank successfully integrated with two systems, including Cisco Finance (telephony system). The project included capabilities for making calls, canceling, and transferring them and was completed in less than two months, including preliminary business analysis. Through this project, Jusan Bank's developers confirmed that Jmix is a convenient tool for tackling tasks within tight deadlines.

Saving Money for the Business

Economic benefits also played a significant role in the choice of Jmix. The bank concluded that hiring one full-stack developer is more cost-effective than engaging separate backend and frontend specialists. This approach allowed for reduced personnel costs without compromising the quality and multifunctionality of the development. The low cost of the Jmix (formerly CUBA) license also had a significant impact.

Low Barrier to Entry

Jusan Bank has a program called "Jusan Singularity," aimed at training young professionals who have just graduated from university and their subsequent involvement in real projects. Jmix proved to be the ideal choice for this program due to its low barrier to entry. In just a month and a half, young specialists were able to understand the specifics of working with Jmix and begin working on the major features in real projects. The quick learning curve and integration of new employees into the team confirmed that Jmix has a user-friendly and understandable functionality that can be mastered and effectively utilized in a short period.

Therefore, Jmix was chosen for its ability to provide fast and efficient development, economic benefits, and ease of learning, making it the ideal solution for a dynamically developing bank like Jusan Bank.

Solution

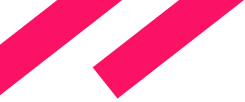

As part of the decision to digitize the bank's business processes by 2021, a team of five developers and two business analysts successfully developed MVPs for four products. By the end of 2023, the team expanded to 16 full-stack developers and four business analysts. The bank implemented several major projects, including integration with Cisco Finance systems, development of a loan pipeline, as well as implementation of POS and EPOS terminals, corporate payment cards, and a lead generation system.

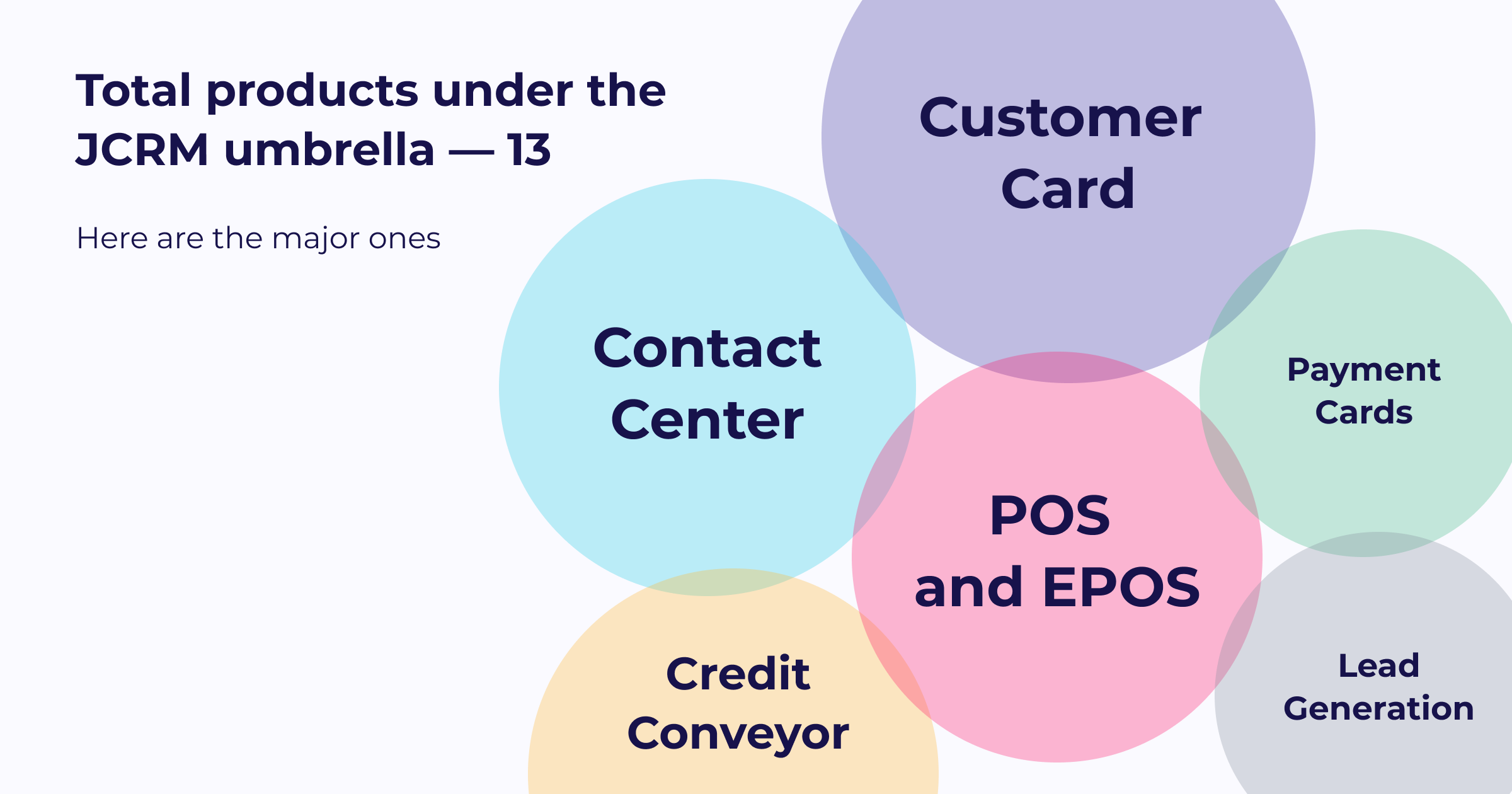

Within the main client application JCRM, which is the key CRM system of Jusan Bank, 13 products were developed using the Jmix platform (formerly CUBA).

Here are some of the key products and features of their development and operation:

Customer Card

The development of this product took a significant amount of time due to integration with the Colvir system. This was done through the JBus bus and calling procedures in the system itself, which was an extremely labor-intensive process. All the costs were justified, as this significantly accelerated many processes in the bank. For example, opening a sole proprietorship is now possible in 3 minutes. Within the customer card, integration through warehouse systems and state services is also used.

Credit Conveyor

This product is a credit issuance process for legal entities, including individual entrepreneurs and companies. The credit conveyor extensively utilizes a BPMN engine, which has implemented four major business processes and about nine subprocesses. This product is also integrated with a decision-making system (DMS) and necessary state services.

POS and EPOS Terminals

These products include both physical and virtual POS terminals. They are integrated with a payment acceptance system and a vendor system, allowing instant firmware updates of terminals through the vendor.

Corporate Payment Cards

This product is a major project in which the bank provides corporate cards to businesses. It has the capability to link up to 30 cards to one legal entity.

Lead Generation

This product helps manage incoming leads and integrates with corporate email and calendar systems, enabling managers to input tasks into the system that automatically replicate to their email or calendar.

Contact Center

This product is integrated with Cisco Finance. Implementing the standard process was labor-intensive and took about two months. As of the last update, the system processed over 25,000 calls in the last quarter alone.

All these products, developed under the JCRM umbrella, showcase the deep integration and multifunctionality made possible by the flexibility and power of the Jmix platform.

Result

Since adopting the Jmix platform, Jusan Bank has undergone significant transformations, moving from traditional banking practices to a digital ecosystem that meets both financial and non-financial needs of its customers. This move towards digital banking is part of its commitment to innovation and technological efficiency, allowing it to meet the growing demands of customers by offering personalized and accessible services. As of 2022, Jusan Bank has expanded to 120 branches in 42 cities, serving 2.5 million customers with a workforce of 8,000 employees.